IRS Payment Millions of people in the United States depend on monthly government payments to manage everyday life. For retirees, disabled individuals, and families receiving survivor benefits, Social Security is not extra income—it is the backbone of their household budget. As prices for food, rent, electricity, and medical care continue to rise, any news about a possible $2,000 payment from the Internal Revenue Service naturally creates curiosity and hope.

Many people are asking the same question: will the IRS really send $2,000 in February 2026? To understand this clearly, it is important to separate facts from online rumors and understand how government payments usually work.

February 2026 IRS Payment Overview

| Category | Details |

|---|---|

| Payment Type | Tax Refund / Benefit Adjustment |

| Maximum Discussed Amount | Up to $2,000 (not guaranteed) |

| Confirmed One-Time Payment | ❌ No official confirmation |

| Linked To | COLA, tax refunds, benefit corrections |

| Payment Month | February 2026 (varies by case) |

| Automatic Deposit | Yes (if eligible) |

| Application Required | No |

| Affected Programs | Social Security, SSI, Tax Credits |

| Official Authority | IRS & SSA |

Understanding Where the $2,000 Figure Comes From

The $2,000 amount being discussed is not a brand-new stimulus check announcement. Instead, it is mostly linked to adjustments in Social Security benefits, tax refunds, and cost-of-living changes that together may feel like a lump-sum payment for some people. In most cases, the IRS does not randomly issue one-time payments unless approved by Congress.

However, people may see deposits close to $2,000 in February 2026 due to delayed tax refunds, Social Security back payments, or combined benefits. This is why the amount is being widely discussed online.

How Social Security Adjustments Work Each Year

Social Security payments increase almost every year through a system called Cost of Living Adjustment, or COLA. This system is designed to protect people from inflation so their money does not lose value over time. The Social Security Administration calculates COLA using inflation data from the Consumer Price Index.

If prices rise during the measured months, Social Security payments go up automatically. People do not need to apply or submit any documents. The increased amount is added directly to monthly payments starting in January.

What Is Expected for the 2026 COLA

As of now, the official COLA rate for 2026 has not been announced. It is usually confirmed in October of the previous year after inflation data from mid-year is reviewed. Early projections suggest the increase may be smaller than recent years, but even a modest rise can still make a difference over 12 months.

For some beneficiaries, the annual increase combined with tax refunds or benefit adjustments may result in a deposit close to $2,000 at some point, especially around tax season.

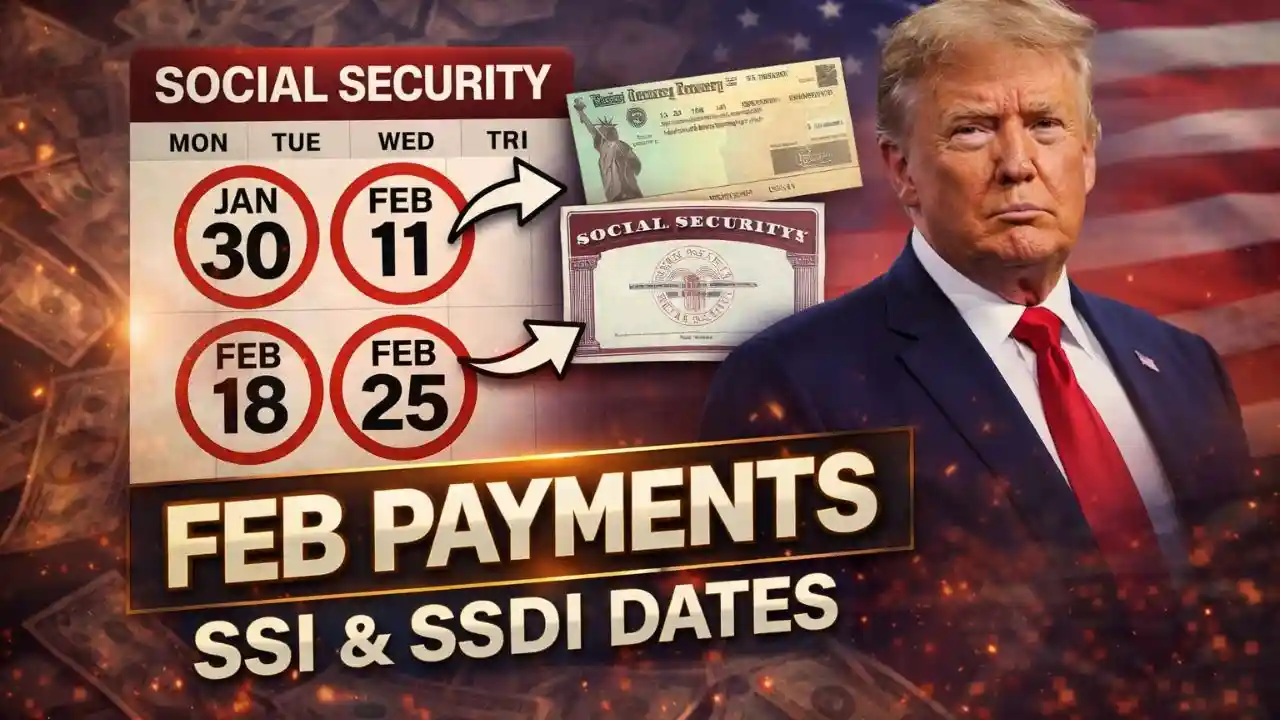

Why February 2026 Is Being Talked About

February is an important month because it often overlaps with tax refund processing and benefit corrections. Many people file their taxes early, and the IRS begins issuing refunds during this period. If someone is eligible for credits like the Earned Income Tax Credit or Child Tax Credit, their refund can be higher.

In addition, delayed Social Security payments or retroactive adjustments may also be processed around this time, making February a common month for larger-than-usual deposits.

How Payments May Appear in Your Account

It is important to understand that not everyone will receive the same amount. The payment size depends on personal factors such as income, benefit type, tax filing status, and deductions like Medicare premiums. Some people may see a higher amount, while others may only notice a small increase.

Direct deposits usually appear automatically in bank accounts linked to IRS or Social Security records. Paper checks take longer and may arrive weeks later.

Medicare and SSI Impact on Final Amount

For people enrolled in Medicare, Part B premiums are often deducted directly from Social Security payments. If Medicare costs increase, the net benefit amount may look smaller even after COLA is applied. Similarly, Supplemental Security Income recipients receive adjusted federal benefits, but state supplements can vary.

This means the final amount you receive may not exactly match the announced increase.

What You Should Do to Stay Prepared

There is no application process for COLA increases or standard tax refunds. However, keeping your information updated is very important. Make sure your bank details, address, and tax filing status are correct. Checking official notices and account statements can help avoid confusion.

Avoid believing unverified social media claims. Always rely on official updates from IRS or Social Security sources.